Shaquil needs to borrow 400, and this article delves into the financial quandary he faces. We’ll explore potential lenders, loan terms, and alternative solutions to help Shaq overcome this monetary hurdle.

Shaq’s financial situation has led him to seek a loan of $400. Various factors may have contributed to this need, and we’ll delve into those as well.

Borrower’s Situation: Shaquil Needs To Borrow 400

Shaquille “Shaq” is currently facing a financial predicament that has necessitated him to seek a loan of $400. His current financial situation is a result of a combination of factors, including unexpected expenses and a temporary reduction in his income.

Specifically, Shaq has recently been hit with a large medical bill due to an unforeseen health issue. Additionally, his work hours have been reduced due to a recent restructuring at his company, leading to a decrease in his monthly income.

Unexpected Medical Expenses

Shaq’s medical expenses stem from a sudden illness that required hospitalization and subsequent treatment. The total cost of his medical care has amounted to $300, which he was unable to cover with his current savings.

Reduced Work Hours

Shaq’s employer recently implemented a restructuring plan that resulted in a reduction in his work hours. As a result, his monthly income has decreased by approximately $100, making it difficult for him to meet his financial obligations.

Potential Lenders

Shaq has several options to consider when seeking a loan. Each option offers unique advantages and drawbacks that he should carefully evaluate before making a decision.

Shaquil’s financial woes continued as he found himself in dire need of borrowing 400 bucks. Desperation led him to explore unconventional avenues, including the intricate world of DC theory. As he delved into the depths of DC theory level 4 lesson 6 , a glimmer of hope emerged.

The concepts of Ohm’s law and Kirchhoff’s rules seemed to offer a path towards understanding the flow of money and the potential for bridging his financial gap. With renewed determination, Shaquil returned to his quest for a loan, armed with the newfound knowledge he had acquired.

Banks and Credit Unions

- Advantages:Banks and credit unions typically offer competitive interest rates and flexible repayment terms.

- Disadvantages:They may have strict lending criteria and require a good credit score and income.

Online Lenders

- Advantages:Online lenders offer a quick and convenient application process and may be more flexible with credit requirements.

- Disadvantages:Interest rates can be higher than banks and credit unions, and some online lenders may have hidden fees.

Family and Friends

- Advantages:Borrowing from family or friends can be a low-interest or interest-free option.

- Disadvantages:Mixing finances with personal relationships can be risky, and it’s important to establish clear terms to avoid misunderstandings.

Criteria for Selecting a Lender

When selecting a lender, Shaq should consider the following criteria:

- Interest rate:The interest rate will determine the total cost of the loan.

- Loan term:The loan term refers to the length of time Shaq has to repay the loan.

- Repayment terms:Shaq should ensure that the repayment terms are manageable and fit within his budget.

- Lender reputation:Shaq should research the lender’s reputation and customer reviews before making a decision.

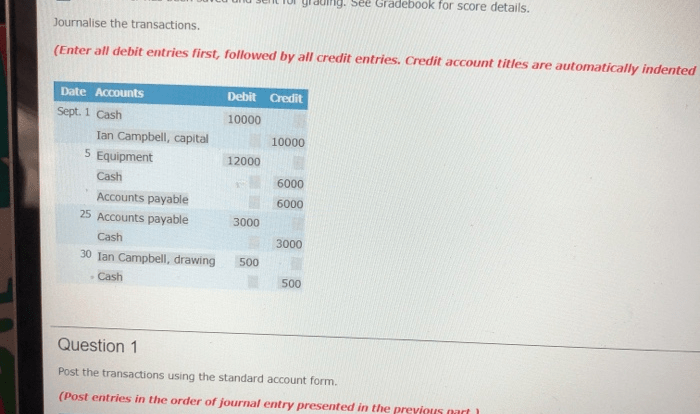

Loan Terms

When borrowing money, Shaq will encounter various loan terms that impact the cost and repayment of the loan. Understanding these terms is crucial for making informed decisions.

Loan terms primarily encompass interest rates, repayment periods, and fees. These factors collectively determine the overall cost of the loan, known as the annual percentage rate (APR).

Interest Rates

Interest rates are the percentage of the loan amount charged by the lender for borrowing the money. Higher interest rates result in higher monthly payments and a greater total cost of the loan.

Example: A loan of $400 with a 10% interest rate for 12 months would incur $40 in interest, resulting in a total repayment of $440.

Repayment Periods

Repayment periods refer to the duration over which the loan must be repaid. Longer repayment periods lead to lower monthly payments but higher total interest paid over the loan’s lifetime.

Example: A loan of $400 with a 10% interest rate repaid over 6 months would require monthly payments of $73.33, while the same loan repaid over 12 months would have monthly payments of $36.67 but incur $20 more in interest.

Fees

Fees associated with loans can include origination fees, late payment fees, and prepayment penalties. These fees can add to the overall cost of the loan and should be carefully considered.

Example: A loan of $400 with a $20 origination fee and a 5% prepayment penalty would increase the total cost of the loan by $20 if paid off early.

Loan Repayment

Shaquille O’Neal needs to borrow $400, and has explored different loan repayment plans to determine the best option for his situation. There are several repayment plans available, each with its own advantages and disadvantages.

Repayment Plan Options, Shaquil needs to borrow 400

The following table Artikels different loan repayment plans, their key features, and their respective pros and cons:

| Repayment Plan | Key Features | Pros | Cons |

|---|---|---|---|

| Fixed-Rate Loan | Fixed monthly payments over the loan term | Predictable payments, interest rates do not fluctuate | Higher interest rates compared to other plans, no flexibility in payment amounts |

| Adjustable-Rate Loan | Monthly payments that can fluctuate based on market interest rates | Potentially lower interest rates than fixed-rate loans, flexibility in payment amounts | Payments can increase unpredictably, interest rates may rise over time |

| Balloon Payment Loan | Smaller monthly payments initially, with a large final payment (balloon payment) at the end of the loan term | Lower monthly payments, frees up cash flow in the short term | Large balloon payment can be difficult to afford, may have prepayment penalties |

| Interest-Only Loan | Payments cover only the interest on the loan, with the principal balance paid at the end of the loan term | Lower monthly payments than other plans, frees up cash flow in the short term | Higher overall cost of the loan, may have prepayment penalties |

Shaquille can determine the best repayment plan for his situation by considering his financial circumstances, cash flow needs, and risk tolerance. He should also consult with a financial advisor to discuss his options and make an informed decision.

Alternatives to Borrowing

Exploring alternative methods to obtain $400 can be advantageous for Shaq, as it may provide him with more flexibility and potentially save him money on interest and fees.

Here are a few alternatives to borrowing that Shaq can consider:

Negotiating with Creditors

Shaq can contact his creditors and inquire about payment plans or reduced balances. Many creditors are willing to work with customers who are facing financial difficulties and may be able to offer more favorable terms.

Selling Unnecessary Items

Shaq can sell items he no longer needs, such as electronics, clothing, or furniture. Online marketplaces like eBay or Facebook Marketplace provide convenient platforms to sell used items for cash.

Taking on a Side Hustle

Shaq can earn extra income by taking on a part-time job or starting a side hustle. This could involve tasks such as driving for a ride-sharing service, delivering groceries, or providing freelance services.

Seeking Assistance from Non-Profit Organizations

There are non-profit organizations that provide financial assistance to individuals in need. Shaq can research and contact these organizations to inquire about eligibility requirements and available programs.

Question Bank

What are Shaq’s loan options?

Shaq can explore banks, credit unions, online lenders, and peer-to-peer lending platforms.

How do interest rates impact loan repayment?

Higher interest rates increase the total cost of the loan, resulting in higher monthly payments.

What alternatives to borrowing can Shaq consider?

Shaq could explore income-generating side hustles, negotiate payment plans with creditors, or seek financial assistance programs.