Income Tax Planning 16th Edition is the definitive guide to maximizing tax savings and achieving financial security. This comprehensive resource provides expert insights, practical strategies, and up-to-date information on the latest tax laws and regulations.

Whether you are an individual seeking to reduce your tax burden or a business owner looking to optimize your tax efficiency, this book offers invaluable guidance. With its clear explanations, real-world examples, and practical advice, Income Tax Planning 16th Edition empowers you to navigate the complex world of taxation with confidence.

Introduction

Income tax planning is a crucial aspect of personal finance, enabling individuals to optimize their financial position and minimize their tax liability.

Effective income tax planning offers numerous benefits, including maximizing after-tax income, reducing the risk of tax audits, and ensuring compliance with tax laws.

Overview of the 16th Edition of Income Tax Planning

The 16th edition of Income Tax Planning provides comprehensive and up-to-date information on the latest tax laws and regulations, including:

- Changes to tax rates and deductions

- New tax credits and incentives

- Updates on tax-advantaged investment strategies

Tax Law Updates

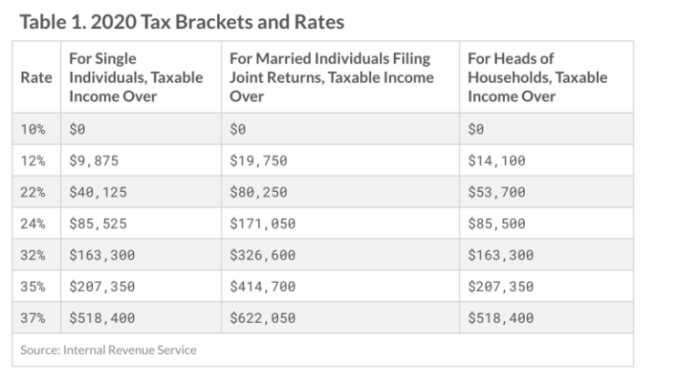

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced significant changes to the tax code, including lower tax rates, an increased standard deduction, and a new 20% deduction for pass-through businesses. These changes have a major impact on income tax planning strategies.

In addition to the TCJA, there have been other recent changes to tax laws and regulations. These changes include the following:

- The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, which made changes to retirement savings rules.

- The CARES Act of 2020, which provided tax relief in response to the COVID-19 pandemic.

- The American Rescue Plan Act of 2021, which provided additional tax relief in response to the COVID-19 pandemic.

These changes have a significant impact on income tax planning strategies. It is important to be aware of these changes and to adjust planning accordingly.

Impact of Tax Law Changes on Income Tax Planning Strategies, Income tax planning 16th edition

The TCJA and other recent changes to tax laws and regulations have a major impact on income tax planning strategies. These changes affect the following areas:

- Tax rates

- Standard deduction

- Itemized deductions

- Retirement savings

- Business deductions

It is important to consider the impact of these changes when making income tax planning decisions. For example, the lower tax rates under the TCJA may make it more beneficial to itemize deductions. The increased standard deduction may make it less beneficial to itemize deductions.

The new 20% deduction for pass-through businesses may make it more beneficial to operate a business as a pass-through entity.

Examples of Adjusting Planning to Account for New Laws

There are a number of ways to adjust income tax planning strategies to account for the new tax laws and regulations. Here are a few examples:

- Consider itemizing deductions if your total itemized deductions exceed the standard deduction.

- Consider making additional contributions to retirement savings accounts.

- Consider operating a business as a pass-through entity to take advantage of the new 20% deduction.

By making these adjustments, you can minimize your tax liability and maximize your after-tax income.

Income Tax Planning Strategies

Income tax planning is the process of arranging one’s financial affairs in a way that reduces the amount of income tax owed. There are a number of different income tax planning strategies that individuals and businesses can use, and the best strategy will vary depending on the specific circumstances.

Some of the most common income tax planning strategies include:

- Retirement planning:Contributions to retirement accounts, such as 401(k)s and IRAs, are tax-deductible, meaning that they reduce the amount of taxable income. Withdrawals from these accounts are taxed at ordinary income tax rates, but they may be eligible for tax-free growth.

- Education planning:Contributions to 529 plans are also tax-deductible, and withdrawals are tax-free if they are used to pay for qualified education expenses.

- Health savings accounts (HSAs):HSAs are tax-advantaged accounts that can be used to pay for qualified medical expenses. Contributions to HSAs are tax-deductible, and withdrawals are tax-free if they are used to pay for qualified medical expenses.

- Itemized deductions:Itemized deductions are deductions that are subtracted from taxable income. Some of the most common itemized deductions include mortgage interest, state and local taxes, and charitable contributions.

- Standard deduction:The standard deduction is a fixed amount that is subtracted from taxable income. The standard deduction is typically higher than the amount of itemized deductions that most taxpayers can claim.

- Tax credits:Tax credits are dollar-for-dollar reductions in tax liability. Some of the most common tax credits include the child tax credit, the earned income tax credit, and the retirement savings contributions credit.

Choosing the Right Income Tax Planning Strategy

The best income tax planning strategy for an individual or business will vary depending on a number of factors, including income, expenses, and financial goals. It is important to consult with a tax professional to determine the best strategy for specific circumstances.

Retirement Planning

Income tax planning plays a crucial role in ensuring financial security during retirement. By optimizing tax strategies, individuals can maximize their retirement savings and minimize the impact of taxes on their retirement income.

Tax-advantaged retirement accounts, such as 401(k) plans, IRAs, and Roth IRAs, offer significant tax benefits. Contributions to these accounts may be tax-deductible, allowing individuals to reduce their current taxable income. Additionally, earnings within these accounts grow tax-deferred, meaning taxes are not due until funds are withdrawn during retirement.

Maximizing Retirement Savings

To maximize retirement savings, individuals should contribute as much as possible to their tax-advantaged retirement accounts. Employers may offer matching contributions to 401(k) plans, effectively increasing the amount of savings available. Additionally, catch-up contributions allow individuals over the age of 50 to contribute additional funds to their retirement accounts.

Minimizing Taxes in Retirement

Planning for tax efficiency in retirement involves considering the timing and sources of income during retirement. Withdrawals from traditional retirement accounts, such as 401(k)s and IRAs, are taxed as ordinary income. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, provided certain conditions are met.

By strategically managing withdrawals and diversifying income sources, such as pensions, annuities, and investments, individuals can minimize their overall tax liability in retirement.

Estate Planning: Income Tax Planning 16th Edition

Income tax planning plays a crucial role in estate planning, as it involves strategies to minimize taxes and preserve wealth for future generations. Understanding the tax implications of various estate planning strategies is essential to maximize the benefits and mitigate potential liabilities.

Effective estate planning requires careful consideration of the following factors:

- Estate size and complexity

- Applicable tax laws and rates

- Beneficiaries’ financial situations and tax brackets

- Estate planning goals and objectives

By addressing these factors, individuals can develop tailored estate plans that align with their specific needs and aspirations.

Tax Implications of Estate Planning Strategies

Various estate planning strategies have distinct tax implications. Some common strategies include:

- Wills and trusts:Wills provide instructions for distributing assets after death, while trusts offer greater flexibility and control over asset management and distribution.

- Gifts:Making gifts during life can reduce the size of the taxable estate and potentially avoid estate taxes. However, there are limits on the amount that can be gifted tax-free.

- Life insurance:Life insurance proceeds can be used to pay estate taxes and provide financial security for beneficiaries. The death benefit is generally excluded from the taxable estate.

- Charitable donations:Bequests to qualified charities can reduce the taxable estate and provide tax deductions.

It is important to note that tax laws and regulations are subject to change, and it is advisable to consult with qualified professionals to ensure that estate planning strategies are up-to-date and compliant with the latest tax laws.

Minimizing Estate Taxes and Preserving Wealth

To minimize estate taxes and preserve wealth, individuals should consider the following strategies:

- Maximize deductions and exemptions:Utilizing available deductions and exemptions can significantly reduce the taxable estate.

- Use trusts effectively:Trusts can be structured to avoid or minimize estate taxes by transferring assets to beneficiaries gradually or upon specific conditions.

- Consider life insurance:Life insurance can provide liquidity to pay estate taxes and reduce the burden on beneficiaries.

- Make charitable donations:Charitable bequests can reduce the taxable estate and provide tax deductions.

- Seek professional advice:Working with qualified estate planning professionals, such as attorneys and financial advisors, is essential to ensure that estate plans are comprehensive, tax-efficient, and aligned with individual goals.

By implementing these strategies, individuals can effectively minimize estate taxes and preserve wealth for future generations.

Tax Audits and Disputes

Tax audits are a critical part of the tax administration process, ensuring compliance with tax laws and regulations. They involve the examination of a taxpayer’s financial records to verify the accuracy of their tax returns and determine if any additional taxes are owed.

Tax disputes, on the other hand, arise when taxpayers disagree with the tax authorities’ interpretation or application of tax laws, resulting in a disagreement over the amount of tax owed.

Understanding the process of tax audits and disputes is essential for taxpayers to navigate these situations effectively. This section provides guidance on preparing for and responding to an audit, as well as strategies for resolving tax disputes.

Preparing for an Audit

- Gather all relevant financial records, including tax returns, bank statements, and receipts.

- Review your tax returns carefully and identify any potential areas of concern.

- Seek professional advice from a tax accountant or attorney if necessary.

Responding to an Audit

- Respond promptly to the audit notice and provide the requested information.

- Cooperate with the auditor and provide clear and accurate explanations for any discrepancies.

- Be prepared to negotiate with the auditor if you disagree with their findings.

Resolving Tax Disputes

- File a formal protest with the tax authorities outlining the reasons for your disagreement.

- Consider mediation or arbitration to resolve the dispute without going to court.

- If necessary, file a lawsuit in tax court to seek a judicial determination.

Resources and Tools

Effective income tax planning requires leveraging available resources and tools. These resources provide valuable information, guidance, and support to assist taxpayers in optimizing their tax strategies.

To effectively access and utilize these resources, it is essential to understand their purpose and capabilities. This includes exploring online databases, government publications, and professional organizations that offer tax-related information and resources.

Professional Tax Advisors

- Consult certified public accountants (CPAs), enrolled agents (EAs), or tax attorneys for personalized guidance and support.

- Seek professionals who specialize in income tax planning to gain insights into complex tax laws and regulations.

- Consider the experience, reputation, and fees of potential advisors before making a selection.

Online Resources

- Utilize the Internal Revenue Service (IRS) website for official tax forms, publications, and guidance.

- Explore online tax calculators and software to estimate tax liability and identify potential deductions and credits.

- Access professional tax journals and articles for in-depth analysis and updates on tax laws.

Government Publications

- Refer to the Internal Revenue Code (IRC) and Treasury Regulations for comprehensive legal provisions governing income taxation.

- Consult IRS publications, such as Publication 17, for detailed explanations of tax rules and regulations.

- Review tax court decisions and rulings for precedents and interpretations of tax laws.

Professional Organizations

- Join professional organizations like the American Institute of Certified Public Accountants (AICPA) or the National Association of Tax Professionals (NATP).

- Attend conferences, seminars, and webinars hosted by these organizations to stay updated on tax developments.

- Access exclusive resources and networking opportunities available through professional memberships.

Helpful Answers

What are the key benefits of effective income tax planning?

Effective income tax planning can reduce your tax liability, increase your savings, and enhance your overall financial security.

What are the major changes in tax laws and regulations covered in the 16th edition of Income Tax Planning?

The 16th edition covers recent changes in tax laws, including the Tax Cuts and Jobs Act of 2017, and provides guidance on how to adjust your planning strategies accordingly.

What are some common income tax planning strategies for individuals?

Common income tax planning strategies for individuals include maximizing retirement contributions, utilizing tax-advantaged investment accounts, and claiming eligible deductions and credits.